Strategy: Ask new questions to get new answers – Part 3: Competitors

There are two main categories of competitors: traditional and emerging. The emerging category includes companies you do not know about yet, but who may be about to take over your market. There are industries such as steel manufacturing where barriers to entry are high, and you are unlikely to be surprised. There are also low-barrier industries such as software and pure import-export businesses. The focus of this article is a set of questions that may help you to gain new insights about your competitors and what you should do to crush them. Above all, remember: to get new answers, you have to ask new questions.

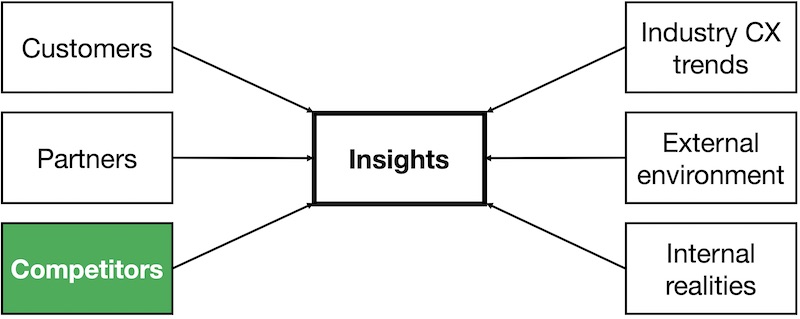

This is the third in a series of articles about what I consider to be the most important aspect of strategy development: an accurate analysis of the current situation and what should be done to improve it. The first article was about customers and is here. The second was about partners and is here.

Emerging competitors

As Willie Pietersen said during the Columbia course I mentioned in the first article in the series, “Somewhere in the world someone has just had a great idea that is going to kill your company.” I won’t bore you with the extensive list of companies that did not notice new threats or did not take them seriously. I suppose those leaders may have been victims of short-termism. By that I mean they felt that they did not need to worry about the new threat during the current quarter as it would not affect short-term financial results. Think of it as similar to the way some political leaders talk about climate change. Nothing they have to worry about or invest in as the worst will happen after they leave office.

Getting started

As mentioned in prior articles, you should use a cross-functional team to agree the list of competition-related questions and then answer them. In a large company, it takes six weeks to do the situation analysis well. You should have a short progress check with your team members each week. What follows below is a suggested set of questions about current and emerging competitors. Please be clear that the list is just there to get you started. This list was developed for the creation of a customer experience strategy and most questions will apply to any type of strategy. Some will of course not be relevant to your business. And you will certainly be able to come up with additional and better questions.

Remember: Ask new questions to get new answers.

The questions

- Do you have competitive benchmark survey data that lets you understand where your competitors provide a superior experience and the situations or touchpoints where you lead. If so, how do you compare with traditional competitors and are new competitors emerging with differentiated customer experience?

- How have competitors’ customer experience strategy and results changed over time? What investments have they been making in people and systems? (Going to their website to look at their list of job openings may help with this.)

- What do your critical competitors say about customer focus and customer experience in their quarterly and annual reports? Is customer experience mentioned on their website as a formal part of their business strategy? How have they set up their customer experience teams and others that support critical touchpoints?

- What customer experience software and consulting companies use your competitors as references on their websites?

- Do you have competitors that have no short-term profit objective and so can outspend you in critical customer experience areas?

- If another company is the customer experience star in your industry, what are the two or three most important reasons for the leadership? Are you able to do those two or three things better than the competitor, or should you be concentrating on doing things differently? (Both work.)

- What customer-experience-related investments have your competitors stopped or radically decreased?

- Do you see competitors whose customer experience [Insert your own strategic focus area if needed] approach differs by country?

Your people who manage customer experience may have some relevant data. The most difficult thing to get is an accurate comparative view of customer perceptions of your company and your competitors. Double-blind competitive research is best, if you can afford it.

The answers lead to insights

If you have asked new questions, the result will be new answers. Just a small subset of these will lead to true insights and actions about the trends in the experience you and your competitors are providing customers. The concept of new or emerging competitors is an important one and deserves special attention.

Conclusion

We have now covered three of the six dimensions of a situation analysis. Next time we will talk about industry trends and the external environment.

As is often the case, the above is a substantial rewrite of part of a chapter in one of our books; in this case Customer Experience Strategy – Design and Implementation. All of our books are available in paperback and Kindle formats from Amazon stores worldwide.