How do you know whether your latest relationship survey score is better than your last one?

This is not a stupid question!

Last week I had the pleasure of speaking to an LA-based reader and head of customer experience for a very large company. He was one of the early readers of our book Net Promoter – Implement the System. He has a great understanding of the different types of customer research. They have been getting in-depth feedback from their top 150 customers for some years. They represent about two-thirds of the company’s revenue, so this matters a lot. Net Promoter Score trends for your largest customers are good predictors of their loyalty and therefore of future revenue trends. In this particular case, the score had declined by a point compared the most recent survey, and he had just been invited to talk to the leadership team about the results. He wanted to be sure he was not missing anything.

Relationship research principles

There are a number of principles that are essential in relationship research. The first one is to ensure you are talking to the correct people. Let me illustrate this with a painful example. When HP and EDS merged, I was in charge of strategy and customer experience for Europe, the Middle East and Africa. I was also the business leader in charge of EDS integration for the geography, quite a challenge given the two companies had about the same number of employees. HP had some CX challenges with Vodafone. I went to their HQ in Newbury and tried to cut the conversation short. “I know you love EDS and want HP to improve a lot. Let’s make it simple. We will copy what EDS is doing.” The Vodafone reply was stunned surprise. “They are even worse than you. What are you talking about?” I proudly put the EDS Voice of the Client executive interview transcript on the table. They looked at it and said “But these people have nothing to do with the contract EDS has with Vodafone. Why were they interviewed?” (The real answer was that EDS had strong incentives on the results, so the account teams gamed the research.)

Survey correct people

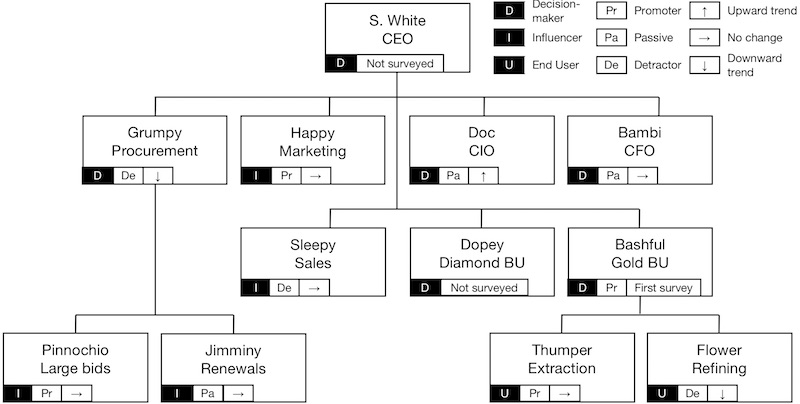

Your research should cover the people who matter in a client organization. Ideally you will interview executives face-to-face. Video conferences, including Skype, are second-best, followed by phone interviews. I don’t believe in email / web surveys for your largest customers, but they are OK for medium to small ones. If you use Salesforce or Siebel, you probably have a ‘relationship map’ that shows the people with whom your sales people interact. If you have a Customer Success team, you may have additional contacts. You need a representative sample of decision-makers, decision-influencers, and in some cases end users too. This mix is one of the reasons you should not report a score by account outside the account team and their direct manager. The various people are not all equal. If you sell IT hardware, software and services, for example, you may interview ten people, but the CIO and procurement manager may have 90% of the decision power.

Understand trends from same respondents

Once you have a good contact list, it is critical to understand the trends from the same respondents over time. What score did they give you last time, and what is it now? Which Net Promoter System category were they in then and where are they now? What comments and suggestions did they make then, and what are they saying now. Did we address the issues they raised the last time? Treat the repeat respondents separately from the new ones. An organization chart like the one at the top of this article may help.

Follow trends in the open text responses

Assuming you record the comments and suggestions made by each interviewee, it is important to track how they change over time. Ideally you should use text analytics software for this, to remove human bias. Software will only give you a good result if you have a reasonably large amount of data, so manual analysis by a neutral person may be needed for individual customers, with automated analysis for the data across all customers. This will also be a good way of picking up trends in comments about your competitors.

Favor supplier surveys

While I am a fan of interviewing customers, there is a better solution: customers’ own supplier surveys. Many large companies have ‘supplier performance reviews’. The process is that the people who purchase or consume products and services from the largest suppliers are surveyed. A report is prepared for each supplier, comparing them to other suppliers and to their prior results. The reason I like this type of research is that the customers have ‘skin in the game’. The procurement department and others probably have incentives to improve supplier performance. This makes the last point I want to make far easier to execute.

Joint improvement initiatives

In an ideal world, you will agree improvement initiatives with your customers and staff them jointly. There are too many negative surprises with the alternate process where you execute without any customer involvement, then they inspect at the end. At the very least, try to get a customer representative to attend your regular progress review calls or meetings. This has a positive effect on the overall relationship too, especially when your competitors do not take the same approach.

A note about how to aggregate scores

You may want to produce an average NPS number across all of your top customers in three different ways. First, just consider all customers to be equal. Second, weight the results by the amount of money they spend with you. Third, weight the numbers by how much each customer spends with all vendors in your market. If the three results are similar, just use the unweighted average, as it is easiest to calculate and communicate. If the three numbers are very different, you will at least have some interesting discussions. What if the customers who spend most in your particular market all seem to hate you?

Conclusion

Relationship research is important and predicts customer loyalty. You can be sure a score is a good one if you interview the correct people and act on their suggestions. Asking people for improvement suggestions and then doing nothing with them will be a disaster, no matter what your score. And always remember that your relationship with your customers may not be as good as you think. You are competing for attention, and your competitor could win!

Note that this article has been written based on content in two of our books: Customer Experience Strategy – Design and Implementation, and Net Promoter – Implement the System. All of our books are available on Amazon. The drawing is by Peter FitzGerald. Feel free to comment and disagree below.