The starting point in any strategy: Situation Analysis

Whether in business, the military, government or indeed non-profit organizations, the the first step in generating a strategy is a comprehensive analysis of your current situation. This is primarily focused on what is happening outside your company. For most companies, it should cover the six areas below and lead to deep strategic insights. ‘Insight’ is a powerful word. Done correctly, you will understand the environment better and more quickly than your competitors, and make superior investment choices.

Set up the analysis

Ideally you will run the situation analysis in parallel in each of the six areas. I suggest using small teams of people from different businesses or functions. In a small company, a single person could do each one. The most important rule is that you can only get new answers by asking new questions. If you ask and answer better questions than those your competitors are asking, you will win.

People who implement must do the planning

A fundamental rule of any successful project is that the people who will have to implement the new strategy should also do the planning. This means that the people who represent each relevant part of your company should do so with the full authority, delegation and agreement of the person leading that entity. If you do not take this approach, critical stakeholders will reject the results of the analysis and you will be unable to implement.

Let’s consider each of the six areas in a little more detail. I have used the development of a customer experience strategy as an example. The principles and analysis areas apply to all businesses. I have included just a few questions for each area below. I will supply a more comprehensive list if your feedback to this article suggests it would be useful.

Customers

This team asks and answers questions about what customer experience expectations your customers have had up to now and how you expect them to change in the future. Here are some sample questions that may help get you started:

- What experiences do your traditional end-customers want at the most important customer journey points? How reliable is your evidence for this?

- How and why are the expectations of your traditional customers changing over time?

- Are there useful ways you could segment customers and provide differentiated experiences to each segment? Should all customers of all sizes and from all industries be treated exactly the same or should you tailor a specific experience for each?

- Do you have any information on how your traditional customers consider their experiences with you compared to what they experience with competitors?

At least half the day-to-day work of most customer experience teams is about listening to customers and partners, then summarizing what they want you to improve. This means that much of the necessary situation analysis information is directly expected from, and controlled by the customer experience leader. Naturally, in small companies, there is no single central reference point, except perhaps the owner or CEO.

Partners

The majority of companies have partners for at least some of their business. The three main categories of partners available to most businesses are resellers, implementation partners, and subcontractors. While you may have some partners who do not work with anyone else, it is more likely that you compete for their attention. Here are some possible questions that may help you to get started with the partner analysis:

- What are the critical touchpoints for your resellers, implementation partners and subcontractors? How have these been changing over time? Are these three categories useful, or is there a better way to segment your partners from a partner experience perspective?

- Should the top few partners, in terms of revenue generation, be treated differently from the rest?

- How does your partners’ experience with your company compare to that with your traditional and emerging competitors?

- Who are your potential new partners, and why?

Competitors

There are two main categories of competitors: traditional and emerging. The emerging category includes companies you do not know about yet, but who may be about to take over your market. There are industries such as steel manufacturing where barriers to entry are high, and you are unlikely to be surprised. There are also low-barrier industries such as software, and pure import-export businesses. Here are some questions that may help analyze the competition:

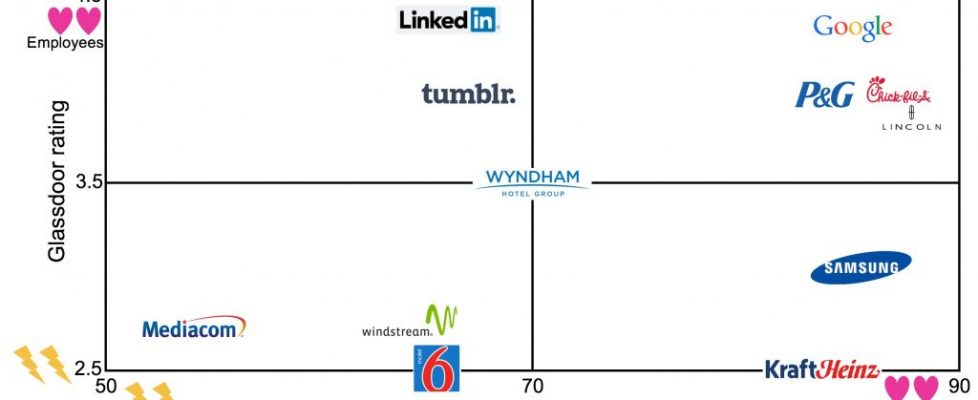

- Do you have competitive benchmark survey data that lets you understand where your competitors provide a superior experience and the situations or touchpoints where you lead. If so, how do you compare with traditional competitors and are new competitors emerging with differentiated customer experience?

- How have competitors’ customer experience strategy and results changed over time? What investments have they been making in people and systems? (Going to their website to look at their list of job openings may help with this.)

Customer experience industry trends

All industries change over time. Customer experience itself has been changing, from at least two perspectives. First, the products and service offerings that help companies to provide better customer and partner experience change over time. Second, there are industry-specific customer-experience changes. For example, ‘Customer Success Teams’ have been implemented by most large software vendors over the last five years or so. These teams help customers to install and understand software, free of charge. Here are some questions that should help this part of the analysis:

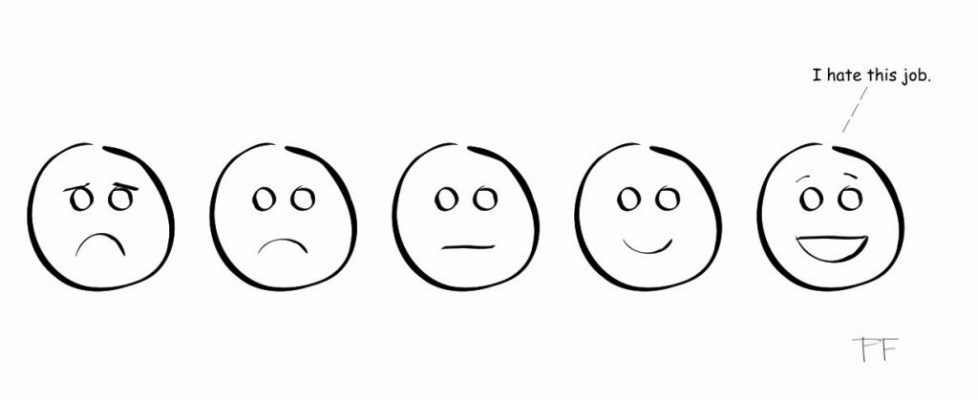

- What is happening in the customer experience industry? What ways of listening to customers are most popular? What new improvement processes and technologies are emerging?

- What is the impact of social media on customer perception of your products and services? Do you know what is being said about you on social media, and does it matter?

External environment

These questions are about the environment in which your company, your competitors and your customers live. It includes government regulation and general concerns and hopes of the people in countries where you operate. You may find these questions useful:

- How does government regulation affect the way you want to go about measuring and improving customer experience?

- What current and emerging rules about data privacy affect your current and potential survey processes?

- Do you know what surveys are being run in your company and whether they respect relevant laws?

Internal realities

While the first five areas are all about what is happening outside your company, you are unlikely to be able to sell and implement every conceivable idea within your company. These questions may help establish what you can achieve:

- What is the state of executive sponsorship for your current efforts?

- How likely are you to be to get any additional funding and people you may need to implement?

- What can you do to prove the value of your work?

- How can you secure enduring sponsorship for your work; sponsorship that will survive leadership changes?

Insights

The result of the situation analysis in each area should be a short list of insights. Each team should aim to have one to three insights and potential initiatives ready to explain and propose at the end of the analysis cycle. If a team has more than three ‘top priorities’, they have probably not put enough thought into it. As French philosopher René Descartes said when writing a letter to a friend (and this is often mis-attributed to Mark Twain), “Please excuse me for writing such a long letter. If I had had more time, I would have written a shorter one.”

Useful insights often take the form of “so therefore…” statements. “We looked at the industry benchmark data from Temkin Group and saw that Acme is outperforming us in this area. We believe we are stronger than Acme here, so therefore here is what we need to do…”

The quality of your insights depends on the quality of your questions

The quality of your insights depends on the completeness of the questions you ask. If you do not ask questions in a critical area, your strategy will be defective. A good question to add in each working session is “What questions have we forgotten to ask?” Before looking at customer research results on a particular topic, you can reduce bias by asking what factors could matter for a decision. It will then be easier to spot things that may be missing from the research. It is even better to do this before you decide what to research. If you have a customer advisory board or simply a set of friendly customers, you may like to ask them the same question.

Conclusion

Situation analysis is quite easy to communicate and understand. It takes about six weeks to do it in depth in a medium to large company. The process described here has been adapted from the one Willie Pietersen describes in his book Strategic Learning. This article is a shortened version of a chapter in my book Customer Experience Strategy – Design & Implementation

, available from Amazon in Kindle and print formats. If you disagree with what I have written, or have other comments and suggestions, please reply below. If you like this sort of article, be sure to sign up for my newsletter here.

Maurice FitzGerald – VP Customer Experience at HP and HPE (rtd.), author, speaker, trainer