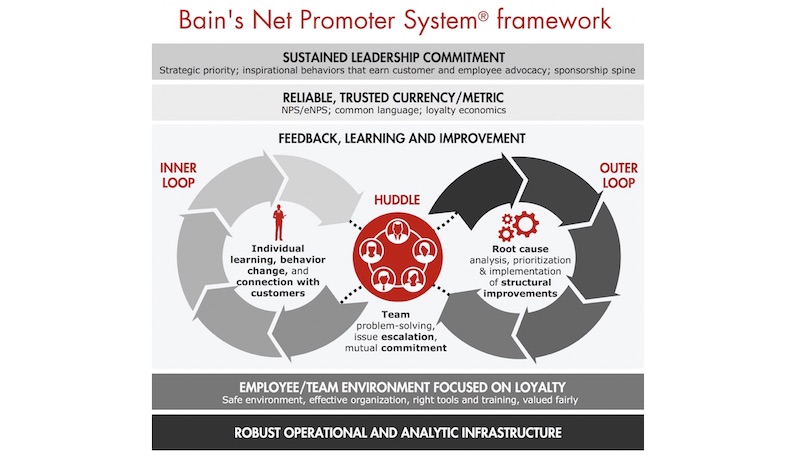

NPS (3) – Net Promoter System Framework, ensuring metric is trusted

The NPS metric is just one part of a much larger system. The Bain & Company Net Promoter System Framework has five elements, as shown in the diagram at the top of this article. It comes from the Bain www.netpromotersystem.com website. The website describes the elements in some detail. This series of articles discusses how to implement each element. The material on some parts of the framework is more detailed than others, notably everything that is involved in ensuring NPS is a reliable and trusted metric in your organization.

Leadership matters

Leadership is important. It is unlikely that the system can be implemented by consensus. Attempts to get everyone possible to agree to what needs to be done will lead to excessive complexity, and lack of clarity about the priorities. Personal leadership is required, and it can only be completely successful in the context of sustained commitment from senior leaders. The articles on each part of the framework will include examples of good practice. Real-world counter-examples are provided between framework discussions. There is somewhat of a theme in the counter-examples: excessive focus on metrics, rather than improvement. We will start by discussing how to ensure NPS is a ‘reliable, trusted currency/metric’, work down the framework, and finish by covering leadership commitment.

Reliable trusted metric – Introduction

The Net Promoter System relies on a metric that is easy to understand, and perhaps paradoxically, easy to misunderstand or even deliberately misuse. There are several different ways of generating a Net Promoter Score. Each has its own specific use. Each is reliable in a different way. It is quite common to see companies advance marketing statements like “Our NPS is 92, with a 30-point lead over our nearest competitor.” No explanation is typically provided about where the number comes from. I have investigated a number of such claims in detail. Typically, the two numbers being compared are from different types of surveys, and are not actually comparable.

This part of the blog series is about how to ensure both a reliable score and a trusted feedback-gathering process. The trust has internal and external aspects. Internally, your colleagues must believe that the feedback is indeed representative of the customer and competitor base it claims to represent. Externally, your feedback and improvement process must provide more value to customers than it extracts. If not, fewer customers will respond to your next feedback request, decreasing reliability.

Making it matter as much as financial metrics

You want NPS to be included in leadership team discussions and to have similar status to any other robust metric, such as your P&L. You need to be able to report your key research results with the same frequency and reliability. If your main financial discussions are quarterly, your main NPS reports should be quarterly too. Just as your P&L is compared to that of your competition, your NPS report should include competitive information as well. Competitive benchmark surveys will be the subject of my next article. And it is perhaps worth noting that as of May 2019, about 150 of the S&P 500 report NPS scores and trends in their quarterly financial reports.

NPS feedback needs to represent your customer population

Assuming you are not wasting your customers’ time and are going to act, you need to ensure your feedback is representative. The purpose of the whole system is to improve loyalty and encourage customers to promote you to others. You need to be clear which customers this means and to target them correctly in any feedback system. To pick an example, if you want to get feedback about your product, but only use data about people who contact you with problems, your feedback system is incomplete at best.

Let me pick an extreme example in another domain to illustrate this. For many years, homosexuality was on the formal US list of psychiatric illnesses. Research by psychiatrists showed that gay people had a truly amazing set of symptoms. The root cause of this classification problem was that the only homosexuals psychiatrists studied were people who had been referred to them because they had psychiatric illnesses. It took many years before this was understood and corrected.

Types of NPS research

The conventional types of feedback scores and input you need to understand and be able to use are benchmark and supplier surveys, relationship feedback, product / service / project feedback, transactional feedback and the feedback from your own employees, known as eNPS or Net Promoter for People. Each can help you to understand and predict different things. They should never be mixed together or compared to each other. Each needs to be reliable and trusted in its own way.

Introducing a new type of research: ‘ceNPS’

I will cover eNPS in a future article about ensuring you have an Employee / Team environment focused on loyalty. At that point, I will introduce a new type of research, which is called customer-employee NPS. The principle is that you ask your own employees how likely customers are to recommend your company, why, and what should be improved. This can be valuable in addition to customer research because employees are better positioned than customers to understand which improvements are easy to implement.

Looking forward

The next article in this series will cover in important aspect of ensuring you have a trusted and reliable metric: competitive benchmark research.

As is often the case, the above is a slightly-edited version of a chapter in one of our books; in this case Net Promoter – Implement the System All of our books are available in paperback and Kindle formats from Amazon stores worldwide, and from your better book retailers.