Customer relationship research / surveys for B2B – Second of three articles

This article follows on from last week’s on the same general topic. I covered the nature of the research and the complexity of typical B2B relationships with large companies last time. This week I want to talk about who should be interviewed, who should do the interviewing, and suggest a few different interview formats. All of this presupposes you have the people and funding necessary to work on the improvement suggestions customers are certain to make.

Who should be interviewed?

If your company uses Salesforce.com or Siebel, you probably have a formal ‘relationship map’, showing who the key people are at the customer end and who interfaces with them at your end, at least from a selling perspective. You may have an additional set of key contact people in your customer service system, and these can sometimes be people the sales team never meet. If you happen to be in software, you may have a Customer Success team with another set of contacts; mainly people using the software. Even if you don’t have such systems, you need to establish a relationship map.

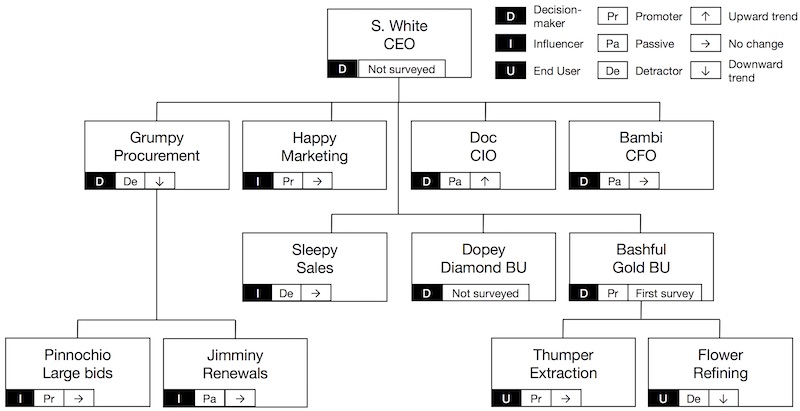

You can think of the customer’s people in three categories: decision-makers, decision-influencers and end-users. They each matter to a different degree. This mix of people is the main reason I feel publishing account-level scores is a bad idea. You will just be kidding yourself if the decision-makers have gone negative about your company while everyone else has become more positive. You need to understand how the views of each key individual are trending.

Customers should agree to the process in advance

If you have an executive sponsor system in place, the executive sponsor should explain the relationship survey and improvement process to the customer in advance. He or she should ask the customer to name a sponsor for the exercise at their end. The customer-side sponsor will be helpful in setting up interviews. Interviews should be done face-to-face, without the sales person or team present. Ideally, the customer should agree to work on the resulting improvement projects with you. The executive sponsor concept will be explained in more detail later in this book.

Who should do the interviews?

Not everyone can get access to every necessary person at the customer end. The most senior people may not want to speak to a customer experience person they feel is relatively junior. At HP in Europe our customer experience people were having difficulty getting access to some senior people at several different customers. We achieved breakthrough when the regional VP responsible for eight northern European countries said he wanted to do the key interviews in the Netherlands himself. He had no difficulty getting access to whomever he wanted. Other people continued to be interviewed by the dedicated customer experience team. If your company operates a ‘future stars’ or ‘top talent’ program, assigning one of these rising people part-time to a customer for a couple of years would be a good idea. This works especially well if the person does not normally have a customer-facing role.

Interview format

A truly outstanding customer experience professional can handle 80 to 100 face-to-face customer interviews for a total of 8 to 10 customers per year. That includes writing them up, agreeing the contents of the improvement plan with the customer and project-managing the improvements. More junior people can do about half that, after their first year. Interviews as described below take about 45 minutes each. While I provide some suggestions here, it is important to pilot this and all other surveys before finalizing your own choices.

No matter what the level of the interviewee, I still suggest starting with your overall rating question, and that this should be the only question where you ask the person to give you a number. Then ask “Why?” In principle, it will take you three levels of “Why?” to get to something meaningful. Once you have suggested and agreed relevant actions, ask what the interviewee would like your company to improve, once again digging down to get practical suggestions. Where the suggestions are unclear, use questions like “How would I be able to know that this action was complete?” Most companies also seem to want to get feedback on the account team, so you can add relevant questions if the subject did not already come up. If the customer has not already listed the account team in the why or improvement answers, your team is at least OK. The overall message here is that the flow should be directed by the customer, not the interviewer. The interviewer provides a framework, and the interviewee provides the detail.

A good way of starting an interview

By speaking to lots of customers and testing different ways of starting the conversation, we have found one that works well. Try starting with “How can I make these 30 minutes into a good use of your time?” I have seen that simple question transform the customer perception of the interview from something that they just need to get through to a true dialog. It lets you understand what the interviewees’ priorities are. You get the opportunity to bring them some value.

A totally different interview format

Probably the most effective interviews I ever did were with co-CEO Bert Nordberg of Sony-Ericsson, Manu Khullar, the CIO of STMicroelectronics and Julio Yepes, the former CIO of BBVA, one of the largest Spanish banks. I filmed the interviews and got their approval to show them to any and everyone within HP. Rather than going through a standard set of questions, I gave them a magician’s magic wand saying, “This wand gives you total control over HP. Make three wishes and I will do my best to make them come true.” I had explained this in advance, and the level of preparation and thought all three put into the exercise was outstanding. Having the ability to show people the video that proved I was not making anything up was useful in getting things done, making most of the wishes come true.

Publish strategic relationship NPS numbers and trends by individual, not by company

Account-level NPS metrics can be counter-productive. If you mainly publish relationship NPS scores for each individual customer and perhaps a table that compares the scores, your metric will never be reliable. Account teams who do not look good on the list will do everything possible to manipulate the process so they do better the next time. To ensure reliability, publish the scores and trends by individual person in the customer relationship map. Your overall relationship with a customer is largely the sum of a number of individual relationships. These are what need to be monitored and improved, or referenced. Improvements should be agreed with each person. Even at the level of the individual, the trend is more important than the absolute number. The diagram below is a suggestion about how to show the relevant information quite simply.

Conclusion

I hope this advice on who to interview, how to do so, and how to track the results will help you. Next week I will cover how to overcome objections to doing the research at all, as well as providing some final tips.

As is usually the case, the content of this article comes mainly from our books. I am sure some of you have additional or perhaps even opposing views. Please feel free to share them below.

June 13, 2017 @ 7:09 am

Maurice, good article and some good ideas here. The only issue I have is with using internal staff to do the interviews. Face to face feedback is almost always more positive than web feedback and when the person is internal it is even more positive still . Especially in high value B2B circumstances the customer has almost as much to lose through a soured relationship as the supplier. So they may be unwilling to rock the boat. Using a third party interviewer to provide an anonymous feedback process can often elicit information you would never hear as a staff member.

June 13, 2017 @ 7:42 am

Good points Adam. Maybe an approach would be to give the customer the choice of using a third party, for the reasons you suggest. The disadvantages I see are mainly:

(1) It is very difficult for a third party to understand what is going on in a complex customer relationship. They are unlikely to know the names of people the customer mentions, and will have only a superficial knowledge of the products and services a company offers. Their ability to drill down into additional levels of detail will therefore be limited.

(2) It can give a message that the company does not care enough about the relationship to do the interviews itself. The message can be “This is a good use of your time, but not of ours.”

(3) Internal people can reject the results of the third party research, believing they did not know how to ask the correct questions, or that much more clarification is necessary before action can be taken.

Of course, customer desire for neutrality may outweigh these points.