#99 – Relationship between employee and customer sat (new study) – Journey mapping for scorecard reporting

New study on relationship between employee and customer satisfaction. Journey mapping. Welcome to the 99th Customer Strategy newsletter. The five topics this week are:

Relationship between employee satisfaction and NPS (not much)Rainy days help my concentration. Regular readers know that I have done three annual studies on the relationship between employee satisfaction and customer satisfaction. For customer satisfaction I have been using the American Customer Satisfaction Index because there used to be no other publicly-available source of such data. For employee satisfaction I have been using Glassdoor ratings for the same reason. As I mentioned a couple of weeks ago, there is a new public source of NPS benchmark data as most Temkin research has now become available free of charge (here). It rained hard on Monday morning, so I decided to add the Temkin 2018 US consumer benchmark NPS data to my ACSI-Glassdoor spreadsheet and compare the results. While both Temkin and ACSI cover over 300 companies, the lists do not match completely. I have been able to match 223 companies in my first attempt. I then calculated various correlation coefficients and R-squared numbers. The results are easy enough to understand, I think. For these 223 companies, employee-satisfaction (Glassdoor) variations explain just 5.8% of the variations in customer-satisfaction (ACSI) numbers and 6.6% of NPS variations. As you would expect, the correlation between customer-satisfaction (ACSI) numbers and NPS is high, at 0.74. What this means is that there is not much of a relationship between employee and customer satisfaction. I have not yet done the NPS analysis by industry and expect to see what we have seen with the ACSI numbers: there is a relatively strong relationship for high-touch industries like hotels, supermarkets, and retail, and a non-existent or even negative relationship for companies where employees don’t have much contact with customers. I think I will need more rainy days to get the time and motivation needed to abandon the ACSI-based approach and replace it with the full Temkin-Qualtrics NPS data. I think I need to do it, since the general level of understanding and acceptance of NPS is much higher than that for ACSI data. Your views welcome. Customer Journey Mapping and scorecard reportingI quite like the principle of reporting customer feedback by touchpoint on customer journey maps. Since I don’t much care for the way most companies approach customer journey mapping, I think this bears some clarification. For brand or relationship-level feedback, I continue to believe the standard three-question NPS format is the best solution. (Rating question, ‘Why?’, ‘What could we do better?’) Many companies add ‘driver’ questions that I consider useless. The driver questions are usually driven by a perceived need to provide a scorecard for each and every department in a company. My suggestion is to prepare a top-level customer journey map and to use it for reporting. Use software or humans to assign each customer response to an open question to one of the steps along the customer journey. This should quickly give you a picture of the interactions the customers like and those that need improvement. You will also see customer touchpoints that receive no feedback at all. In general, this means they are good enough and don’t need to be improved. An exception would be something that is central to your customer strategy. For example, if you have spent a lot of money to provide faster delivery than all of your competitors but fast delivery is never mentioned by your customers… well… you may have made an incorrect strategy choice. This type of feedback would indicate that extra-speedy delivery is not important, so you can save some money and just make it as fast as your competitors’ delivery. Finally, don’t get too granular. If you get three thousand survey responses every month and have customer journey points that get just one or two comments, you may have broken the customer journey down to too fine a level of detail. Conversely, if you have one step that gets 600 comments you should probably break it down into several elements.

Our latest blog postsI continue getting feedback on my Elon Musk / Tesla article via LinkedIn and directly. I think his recent launch of 60 clearly visible satellites that are disturbing astronomic observations is another indication that his ‘golden touch’ may be fading. The posts on this list are part of my extensive and deep series about the Net Promoter System. Older posts are still available on the blog page.

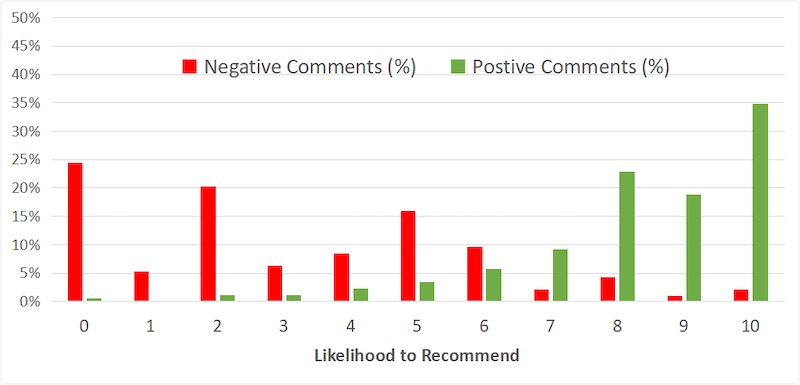

Notable customer experience items from other sitesMeasuringU – Do Detractors really say bad things about a company

One question that comes up quite frequently is whether there is any actual evidence that Promoters, Passives, and Detractors actually exhibit the behavior they are theoretically supposed to exhibit. This article is the result of a deep research on the subject. Among other things, it shows that 90% of all negative comments about a company do indeed come from Detractors. The author (Jeff Sauro, PhD) has put a lot of effort into the paper. Read it here. MYcustomer – Why do we ignore the end of the customer lifecycle when building personas?Joe Macleod has written a really thoughtful article about something we never think about: What about customer off-boarding? We concentrate our CX efforts on our current customers and I suppose on new customers too. We never give a thought to those who are leaving us, whatever their reasons. Some of these reasons can be tragic, of course. I remember the difficulties I had helping my best friend’s family cancel his car insurance after he was killed in the crash of Swissair flight 111 from New York to Geneva. OK that’s an extreme case and what Joe has written is somewhat more run-of-the-mill. Read his article here.

Looking forwardI will continue to try to publish two blogs per week over the coming month or two and do my best to take the research on the relationship between customer and employee satisfaction a little further. Here are links to all of our books on Amazon.com. Kindle versions are available in all stores. Print versions are available from the major stores only. And as of two weeks ago, you can find the books, or at least order them in many bookstores. If you have already read any of our books, please write reviews on Amazon. Customer Experience Strategy – Design & Implementation Net Promoter – Implement the System Customer-centric Cost Reduction “So Happy Here”: The Absurdist but Essential Guide to Better Business (Color edition) “So Happy Here”: The Absurdist but Essential Guide to Better Business (Black & White edition) Please share this newsletter with your friends and colleagues and encourage them to sign up for it here. I have put links to past newsletters on the subscription page. Finally, please feel free to change or cancel your subscription using the link below. You can also email me, Maurice FitzGerald, at mfg@customerstrategy.net. |

||||||

|

|