NPS (5) – Relationship research with large B2B customers

A good relationship feedback process could be described as a non-anonymous mono-vendor benchmark survey. You usually only get detailed information about your own company. If you just have a small number of customers, say less than a hundred, you should simply interview them all face-to-face. If you have a large number of customers, you should segment the customers in some way, using increasing depth for your most important customers. Deeper surveys do not mean asking more questions. The Net Promoter System format remains intact. When you interview your most important customers, you go into far greater depth on the ‘Why?’ and ‘What should we improve?’ questions. Clarifying the input right away will make it far easier to prepare a worthwhile improvement plan for the customer to approve.

It is certainly possible to add questions about competitors to your relationship survey, though it would dilute the focus on your own company’s improvement opportunities. In cases where your product and your competitor’s are mutually exclusive, meaning nobody would buy from both companies, adding questions about competition would give you an early indication about whether customers are thinking of changing. For example, “Why do you buy from us instead of [insert key competitor name]?

Resellers and other partners

Companies that help you to sell or implement your products and services are a special case. Since their job is to recommend your products and services, asking them the recommendation question is not appropriate. I recommend asking “Please rate your overall satisfaction as an Acme partner”, followed by the usual “Why?” and “What should we improve?” Since your partners have the choice of working with other suppliers, they are a good source of competitive information. I therefore suggest adding the following questions, using a reseller example, and supposing that the main competitors are called Alpha and Beta:

- Do you sell products from Alpha or Beta?

- What can we at Acme do to make it easier for you to recommend us over Alpha and Beta?

Future-facing relationship segmentation

I believe it is more useful to segment your research and improvement process by your future revenue expectations for a customer, rather than by what you achieve now. This means that customers who spend a lot on your type of product or service deserve a lot of attention, no matter who they spend it with. I suggest a two-year time horizon. The segmentation is used to determine the type of feedback process you will use. The top tier should be interviewed face-to-face, the second tier by phone or Skype and the lowest tier by email / web. The depth of your loop-closing and improvement commitments will also vary by tier.

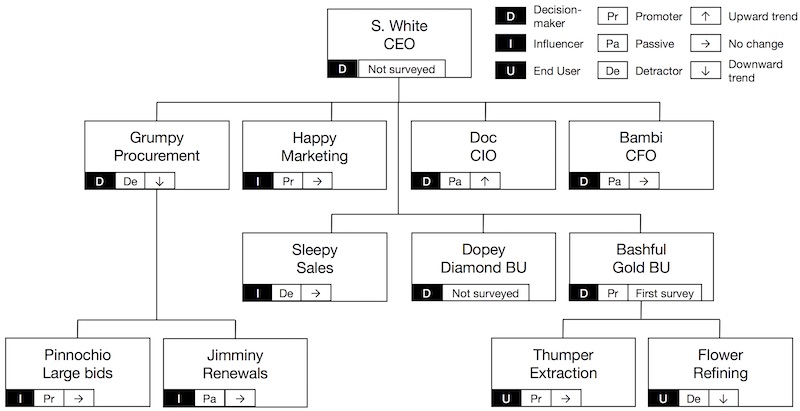

Publish strategic relationship NPS numbers and trends by individual, not by company

Account-level NPS metrics can be counter-productive. If you mainly publish relationship NPS scores for each individual customer and perhaps a table that compares the scores, your metric will never be reliable. Account teams who do not look good on the list will do everything possible to manipulate the process so they do better the next time. To ensure reliability, publish the scores and trends by individual person in the customer relationship map. Your overall relationship with a customer is largely the sum of a number of individual relationships. These are what need to be monitored and improved, or referenced. Improvements should be agreed with each person. Even at the level of the individual, the trend is more important than the absolute number. The chart at the top of this article is a suggestion about how to show the relevant information quite simply.

Looking forward

The next article in this series will cover will be about how to get actionable feedback for individual products, services, and projects.

As is often the case, the above is a slightly-edited version of a chapter in one of our books; in this case Net Promoter – Implement the System All of our books are available in paperback and Kindle formats from Amazon stores worldwide, and from your better book retailers.