Win-Loss analysis – Here is a method that works

One of your sales teams is celebrating! They just won a big deal they have been working on for the last four months. Another team has lost a similar deal and wonders why. Why did one win and the other lose? What can you learn to improve the chances of winning the next time? These are the questions win-loss analysis sets out to answer.

Win-loss analysis is a subset of relationship surveys. You use the relationships you have within a company to understand why you won or lost a large bid. Many companies claim to do win-loss analysis but do it poorly. When we were working out why the analysis did not produce useful insights for large deals at HP, we developed a better approach. We then applied it to deals over $100,000 in many countries.

Common practice and common results

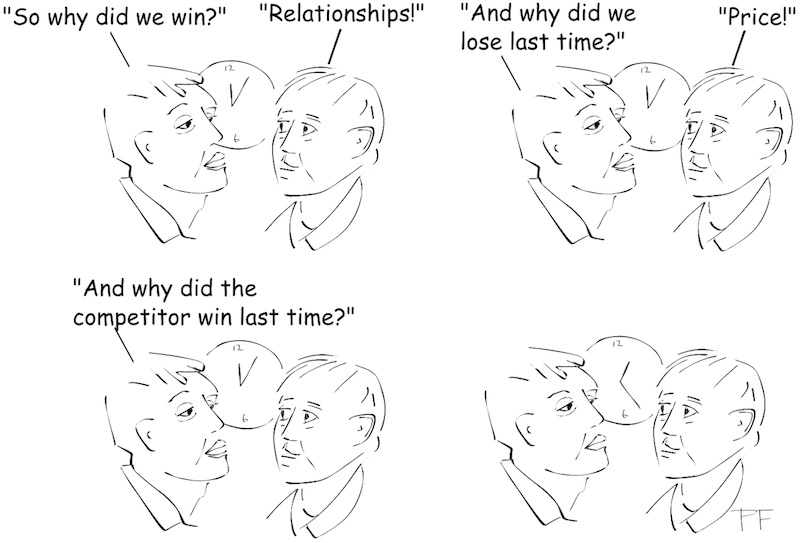

Most companies do win-loss analysis in-house. By this I mean someone asks various people inside their own company why a deal was won or lost. Human nature means this approach turns out not to be useful. Worse still, you may think you are learning something, but you are not. Take the example of the sales teams. Where the deal was won, the most common explanation given by sales teams is that they won because of their outstanding relationships with the customer. Where the deal was lost, the sales teams most often say it was due to price. Each team in your own organization is likely to attribute some part of each win to themselves, and to distance themselves from any reason for losing.

A characteristic of B2B relationships is that your customers want you to be competitive. If you lose, they want you to do better next time, even if only to get an even better deal from whoever won this time around. If you win, they would like to be clear on exactly why. What this means is that your customers will accept your request to involve them in win-loss analysis, no matter which way the most recent deal went.

Six-factor model for win-loss analysis

The diagram below shows six competitive factors that should serve as a good starting point for your win-loss analysis. Ask the same questions to the customer and to your own team. The questions should be asked about your own bid and the winning bid when you lose, and about the second-placed bid when you win. Where you will learn the most is where the customer and internal answers differ most. The diagram below shows a situation where a competitor (BetaCorp) won, and the key differentiator was the project proposal presentation.

Sample questions

You will probably want to discuss and finalize your own questions for each section. Here are some suggestions:

- Customer knowledge

- On a scale from zero to five, how well does each company understand your business and market environment?

- How well does each company understand your business needs and challenges?

- How good is the business relationship between each of these companies and your company?

- Project or deal knowledge

- How well did each team understand your organization’s needs and critical success factors for the project?

- How well did each company understand your decision-making process and make it easy for you to gain approval?

- To what extent did each company help you define the requirements for the project?

- Solution fit

- How well did each proposed solution fit your needs?

- Solution price

- How competitive was each price?

- How attractive was the return on investment proposed by each company?

- Project team

- How experienced did you feel each team was with this type of project?

- How would you rate the competence and professionalism of each team?

- How available was each team to quickly answer your questions?

- Project presentation

- How accurate and complete was each project presentation?

- To what extent did the presentations give you confidence the project would succeed?

Adjust the interview format for each interviewee

The more senior the person at the customer end, the less happy they are likely to be with the use of a formal questionnaire. One approach would be to do your best to memorize the questionnaire and to take notes about the answers. I believe you can be totally open about the ‘spider web’ diagram that shows the overall positioning of your company compared to the best competitor. Try developing it directly with the person you are speaking to, perhaps using a whiteboard and photographing it when done.

Who should ask the questions?

The ideal person is the one who also manages your company’s relationship survey and improvement process, assuming such a person has been assigned to the customer and works with the sales team. This is of course less likely to be the case if the deal is with a new customer, with no existing history. In such cases, use a person from your customer experience team, or a ‘top talent’ your company is trying to develop.

Reporting out on win-loss analysis

The customer should be first to receive your draft report, especially if you have spoken to more than one person. You may surprise them with the feedback summary and need to make edits. Your own sales team should be next, together with any partner you may have used for the bid.

From that point on, some caution is needed. There is no issue with sharing win reports with sales and general management. If you have lost, I believe you should leave it up to the relevant sales leader whether to share the report upwards or not. If the customer experience team distributes individual loss reports broadly, their relationship with the sales team will deteriorate rapidly. Aggregated reporting, covering many wins and losses, is the most diplomatic approach.

Conclusion

Done competently, and managed diplomatically, win-loss analysis is a great training tool for sales teams and for those who support them. The purpose of the analysis is simple: to win more deals. Try it!

The above is an edited version of a chapter of our book Customer Experience Strategy – Design & Implementation. Descriptions of all three of our customer strategy books are on our website.