#101 – Choosing projects, benchmarks, tech support cartoons

Welcome to the 101st Customer Strategy newsletter! The five topics this week are:

Unusual tips on prioritizing / choosing improvement initiativesLike many of you, I suppose, I have often been confronted by the need to choose among possible projects. This happens in every business area, not just customer experience. I won’t bother you with the usual and obvious selection criteria such as ROI. What follows is a more personal list. These are three factors I have found to be important over time and I hope you will find something new here.

Why not share your benchmark NPS data with customers?If you are among the many companies that have reliable customer experience benchmark information, why not share that information with your customers? There is no individually identifiable customer information in such data, so you should not have any privacy concerns. Your company does not have to be the best one on the list. Indeed it may make you seem even more honest and open if you are not at the very top. When I say ‘reliable customer experience benchmark information’, here is what I mean:

Of course, you may not want to make broad public announcements that provide a ranked list of all relevant companies. Comparing yourself to the competitive average may be enough. This was all brought to mind by a new blog post by Dr. James Borderick of Micro Focus. He openly says that Micro Focus is ranked 12th among 50 companies covered by the double-blind research. He then goes on to provide a comparison between Micro Focus and the average company for each of four subsets of the overall software business. If you find the rankings strange compared to the overall ranking, just bear in mind that there are fewer competitors in each of the subset areas than in the overall total, as not everyone competes everywhere. Where you have a particularly strong position, I suggest providing your sales people with the full details. I can’t think of a reason not to let them show customers how you compare to other companies they may be considering. Have a look at the Micro Focus information here.

Our latest blog postsThe posts on this list are part of my extensive and deep series about the Net Promoter System. The one at the top of the list is one of the most popular articles I have ever written. (Thank you.) Older posts are still available on the blog page.

Notable customer experience items from other sitesReader’s Digest – 25 funny cartoons technophobes can appreciateThese seem to be quite old, given what computers look like in many of them. Some real goodies. I particularly like the one about the virus. Have a good laugh here. Joy King – Vertica scores big in customer satisfactionSince we have already been on the subject of Micro Focus above, here is an additional example of the use of double-blind NPS research data in customer communication. Joy King is a former colleague of mine and is VP of Product Management and Product Marketing for the Vertica business. Vertica can best be described as a columnar database. Columnar databases are many times faster than relational databases. Even when I worked at HP part of their customer list was a secret. I never learned why and speculate that the major Silicon Valley companies who were customers wanted $$$ for us to use them as references. I agree with about 95% of what she has written here. My hesitation is for what she says about benchmark NPS numbers above 60. They are rare, but they do exist. She is right that you should treat such numbers that are presented without details of how they are determined as probably bogus. Read Joy’s article here.

Looking forwardCurrently negotiating two speaking engagements for after the summer vacation period. You can see a video of on of my keynotes here. Just email me at mfg@customerstrategy.net if I can help motivate or inform your team.

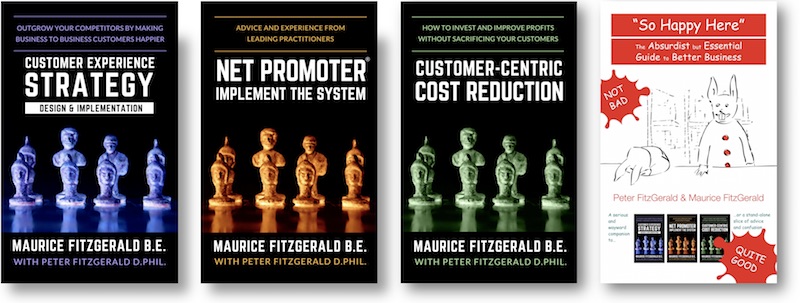

Here are links to all of our books on Amazon.com. Kindle versions are available in all stores. Print versions are available from the major stores only. And as of two weeks ago, you can find the books, or at least order them in many bookstores. If you have already read any of our books, please write reviews on Amazon. Customer Experience Strategy – Design & Implementation Net Promoter – Implement the System Customer-centric Cost Reduction “So Happy Here”: The Absurdist but Essential Guide to Better Business (Color edition) “So Happy Here”: The Absurdist but Essential Guide to Better Business (Black & White edition) Please share this newsletter with your friends and colleagues and encourage them to sign up for it here. I have put links to past newsletters on the subscription page. Finally, please feel free to change or cancel your subscription using the link below. You can also email me, Maurice FitzGerald, at mfg@customerstrategy.net. |

||||||||||||

|

|