The main customer experience measurement and improvement systems – Part 5 – The Wallet Allocation Rule

Authors Keiningham, Aksoy, Williams and Buoye describe the system in the book of the same name. Its focus is a composite metric that combines the list of brands that a customer thinks of and their relative satisfaction with the same brands. Their research on the metric is sound and predicts share of wallet well in consumer businesses. While they focused on consumers, it seems reasonable to believe the same logic would apply to B2B situations. Even though the book documents some incorrect assumptions about how the Net Promoter System works, the conclusions are still valid. I consider this as one of several composite metrics that should indeed have better predictive value than NPS in specific situations. All share the same issue of being relatively difficult to communicate, in part because they are not as simple or popular as NPS.

Six-step measurement and improvement process

Here are the six steps in the Wallet Allocation Rule process:

- Survey your customers to find out how they rank you and the competitors they also purchase from. The ranking is based on their satisfaction, NPS or a similar metric. Since this ranking is the numerator, it is fair to say that the overall equation represents a sophisticated manipulation and improvement of the satisfaction or NPS score. Note in passing that the authors disagree strongly with what I have just written, but I believe no other logical conclusion is possible.

- Apply the Wallet Allocation Rule to establish the share of wallet for each competitor.

- Determine how many of your customers use each competitor.

- Calculate the revenue that goes from your customers to each of your competitors.

- Identify the primary reasons your customers use your competitors.

- Prioritize improvement opportunities.

Let’s consider these steps in more detail, comparing them to other methods.

Survey your customers to find out how they rank you

While the authors did this initially as a one-off high-volume exercise, it is hard to get this step to work well if you do the surveys yourself. If the survey goes out in your name as the authors suggest, the respondents will be biased in their responses. That bias will only affect the answers about your own company. There is no reason to believe the bias would affect the other competitors’ scores relative to each other. You could of course use double-blind benchmark surveys administered by a third party. This is identical to the benchmarks survey method used for other improvement processes.

Apply the Wallet Allocation Rule

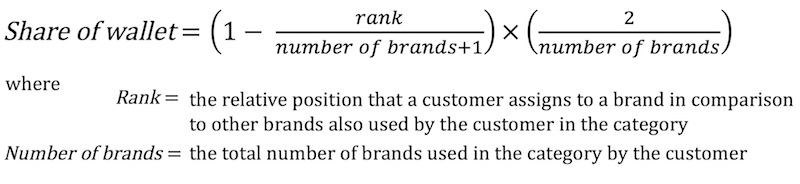

First, what precisely is the Wallet Allocation Rule? The formula at the top of this article shows how it is defined in the book.

This should work as a predictive metric providing the customer continues to split their purchases among the same brands. There are industries that are relatively stable and where that logic is sound. There are industries with low barriers to entry, such as SaaS software, where it does not work at all. In fast-changing industries, you are better off using the relative NPS rank in the market, rather than by customer. IBM, Computer Associates and HP learned this the hard way. For many years, the three companies shared the majority of the market for system-management software. Then one fine day, Service Now came on the scene with a new type of software that required no new hardware to run it. They went from nothing to a market-leading position in just a few years, despite awful customer satisfaction at the start. Indeed, with the satisfaction ranking numbers they had in their first couple of years, the Wallet Allocation Rule would have predicted their quick demise. The Net Promoter System, with its focus on trend, correctly predicted the opposite. The source for this statement is double-blind benchmark studies carried out for HP by IPSOS.

Determine how many of your customers use each competitor and the revenue share for each

This exercise is useful in any case, if you want to understand what you have to gain and lose financially. One challenge is making sure your sample is representative of your customers as a whole. Are very large customers adequately represented? Do the people who responded to the survey actually have decision power?

Identify reasons customers use competitors and prioritize improvement opportunities

The processes described in the book for this have the merit of using a reasonably strong financial basis for justification calculations. There is a lot to be learned from reading the explanations. The belief that you will get the predicted financial result is based on a debatable premise, which is that competitors will do nothing while you are driving improvements. If competitors improve at the same pace as you do, you don’t gain share, but at least you don’t lose share. These issues are common to all improvement systems.

Conclusion

I don’t believe the Wallet Allocation Rule method to be fundamentally different to the Net Promoter System. I like the fact that it relies on competitive rankings, and these should be part of a good relationship survey process in the Net Promoter System too. The calculations make the Wallet Allocation Rule more difficult to explain. The book makes questionable references and assumptions about NPS. The most fundamental issue is that it states repeatedly that NPS does not use relative rankings, whereas The Ultimate Question 2.0 repeatedly states that future market trends are predicted by NPS trends relative to those of your competitors. The difference between the two methods is that NPS takes a supplier-side view and the Wallet Allocation Method takes a customer-share-of-wallet view. They should produce similar predictions in stable markets. In software and other dynamic markets, I believe NPS will produce better predictions because it counts competitors that customers may not currently be using.

For reasons that escape me, the authors of The Wallet Allocation Rule disagree with just about anything negative that I have written about their system. I have a feeling that the objections are based on their theory that research done by companies is of less good quality than that done by academics, though they have not directly said that to me. Of course I believe that objection is invalid. I recognize that academics do not have access to the many millions of company-confidential responses that companies have received from double-blind competitive research, so there may be an element of frustration about that. I don’t know really.

Recommendations

While I recommend their book, I do of course have to recommend my own books too. This article is a slightly modified part of a chapter in Customer Experience Strategy – Design & Implementation, one of four books written in collaboration with my artist / cognitive psychologist brother Peter. The others are Net Promoter – Implement the System, Customer-Centric Cost Reduction, and a book of Peter’s illustrations, with learning points: “So Happy Here” – The Absurdist but Essential Guide to Better Business.

And as always, feel free to comment on this article below. Next time: Proprietary systems.