NPS (6) – Getting useful feedback about one of your products, services, or customer projects

Unless your company only sells a single product or service, you need a separate process to gather feedback about each product or service you sell. While benchmark and relationship surveys cover a variety of people and job roles at the customer end, product and service feedback should come from the end users. To get reliable and credible information, you should ask for it when you are explicitly planning to use it. For a service contract that you are going to renegotiate (for example), get feedback from the end users before the negotiation starts and use it to present a more convincing case for renewal.

For products, tell the end users that you are starting a new design cycle, solicit their suggestions, and tell them which suggestions were most common and will be included in the next product or version. If you have customers who are references for your product, pay particular attention to what they say. Your most reliable feedback will come from customers who actively use the product or service. For this type of survey, I don’t think it matters whether they have purchased it recently or not. Indeed, an end user may have no idea when the purchase decision was made. If your survey is about something like software that has versions, you will need to ask the users what version they are using if you don’t already know. If so, make sure you tell the users how to determine the version number.

Project surveys

Assuming you want to improve the way you plan and deliver customer projects, a formal feedback process is good practice. I have never seen these done well and they are indeed tricky. I believe you should consider project surveys as the least reliable in your portfolio. The reasons are quite complex, and change somewhat between shorter (up to three months) and longer projects:

- The people who will answer the survey are most often chosen when the project is complete (for shorter projects) or when a major milestone has been achieved. Since the project team normally chooses the people who should provide feedback, they have an understandable tendency to select only those who will give favorable answers. Ideally, this can be offset by agreeing the names or job titles of those who will respond in the project contract. Unfortunately, I have never seen this done, both because people want to use standard contracts, and because they do not want to “waste time negotiating details.”

- Another possibility is to be clear, both in theory and in practice, that you are not going to measure the project team on the customer feedback. Emphasize that you will use the feedback to improve the processes and tools for all projects, as well as to plan the development of project team members. It is almost impossible to communicate this credibly. Are you really willing to discard customer feedback when putting project team members through their performance reviews? The only thing left is to have a person outside the project team agree the names of those who will provide feedback. This can be the executive sponsor for the customer, if you have one, or the sales leader assigned to the customer.

- For longer projects, the members of the project team and the overall project manager may change over time. It is quite common to see a first team for a proof of concept, a second team for a pilot and a third team for a comprehensive rollout. In such situations, you should not have a single feedback process, but have at least one for each phase. Working purely by phase is deficient too, as lack of project management continuity across phases is a common customer complaint.

While remaining aware of the aforementioned defects, my recommendation is to track trends by manager of project managers. It seems reasonable to expect that a single project manager will introduce the same conscious or unconscious bias to all project surveys over time. Tracking at the manager level will smooth it out somewhat.

Projects involving Alliances

Most people think of alliances between companies as being two-way affairs. However, it commonly takes three or more companies to implement a customer project, and any research process must take that into account. If a customer receives a survey from only one of the companies involved in implementing a project, they are likely to be surprised. An example may help here.

When I was managing certain software alliances at Compaq, I got a surprise. I had Lotus as one of the services alliances I led at a worldwide level. Lotus had been acquired by IBM about 18 months previously. IBM encouraged them to continue to act as though they were independent. One consequence of this was their love of Compaq. 55% of all the Lotus Notes installations were being sold on Compaq ProLiant servers, and the proportion was increasing slowly, to the irritation of Lotus’s new masters. I was in their Cambridge Mass. HQ, trying to work out how to use services to grow our joint business. It turned out that neither Lotus nor Compaq wanted to be ‘Prime contractor’ for any Notes implementations. A simple two-way alliance was pointless.

Further discussion revealed that the largest Notes implementer on the planet was PricewaterhouseCoopers (PwC), and that this was particularly the case in EMEA. I met repeatedly with the head of the PwC Notes practice in Zurich, and we were successful in some three-way projects with Lotus. (Then HP tried and failed to acquire PwC, ruining the PwC/Compaq work, though this is not directly relevant here.) Two- and three-way alliances are quite common for customer projects. You need to agree a single approach to surveying the whole project and driving improvements together.

Training surveys

Since I have taken many training courses over the years, I have been surveyed many times. Surveys tend to be quite long and to involve rating the teachers. Oddly, I don’t recall ever being asked what any individual teacher could improve. I feel NPS can be used in a hierarchical way, starting with an overall course score, and the usual Why and Improve questions. This can be followed by the same three questions for each teacher. I do not believe you should ask about the course material, facilities, catering, accommodation and so on. If they matter, they will come up in the written comments. Unfortunately, trainers tend to want to train you on how to answer the surveys. They will typically show a slide that gives a sample score (always a 10), and sample comments, which are always positive. This is a misguided approach and means the trainers do not get many of the improvement suggestions they need.

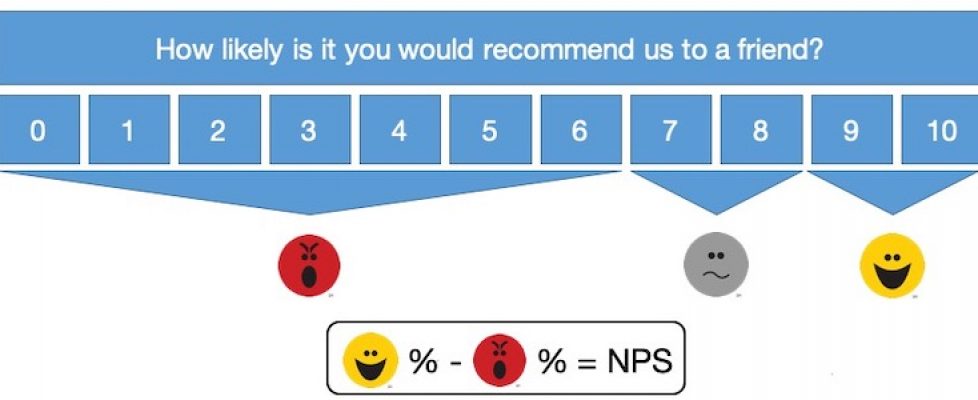

Note that the Bain NPS emoticons at the top of this article are registered service marks and are used with permission.

Looking forward

The next article in this series will cover will be about how to handle transactional / episode research.

As is often the case, the above is a slightly-edited version of a chapter in one of our books; in this case Net Promoter – Implement the System All of our books are available in paperback and Kindle formats from Amazon stores worldwide, and from your better book retailers.